By Ashlea Ebeling

By Ashlea EbelingMany Americans will see their tax burden drop next year because of inflation adjustments made by the Internal Revenue Service. Some will benefit more than others.

The inflation adjustments affect tax deductions for workplace benefits such as 401(k) retirement accounts and commuter accounts./PHOTO: GETTY IMAGES

The inflation adjustments affect tax deductions for workplace benefits such as 401(k) retirement accounts and commuter accounts./PHOTO: GETTY IMAGES

The IRS makes annual inflation adjustments to dozens of tax provisions, including the standard deduction and income-tax brackets, based on formulas set out in federal law. The recent run of record inflation led to significant modifications for 2023.

Inflation adjustments aren’t a tax cut but are intended to help offset the effects of rising prices.

People who get raises next year to help offset the effects of inflation could still face bigger tax bills for the 2023 tax year, even with the higher tax-bracket thresholds, says Ben Henry-Moreland, a certified financial planner in Omaha, Neb. Even though they’ll pay more in dollar terms, they could still be paying less as an overall percentage of their income.

“This isn’t really a gift to taxpayers. It’s more like keeping us in the same boat,” says Morris Armstrong, a Cheshire, Conn.-based tax adviser and enrolled agent.

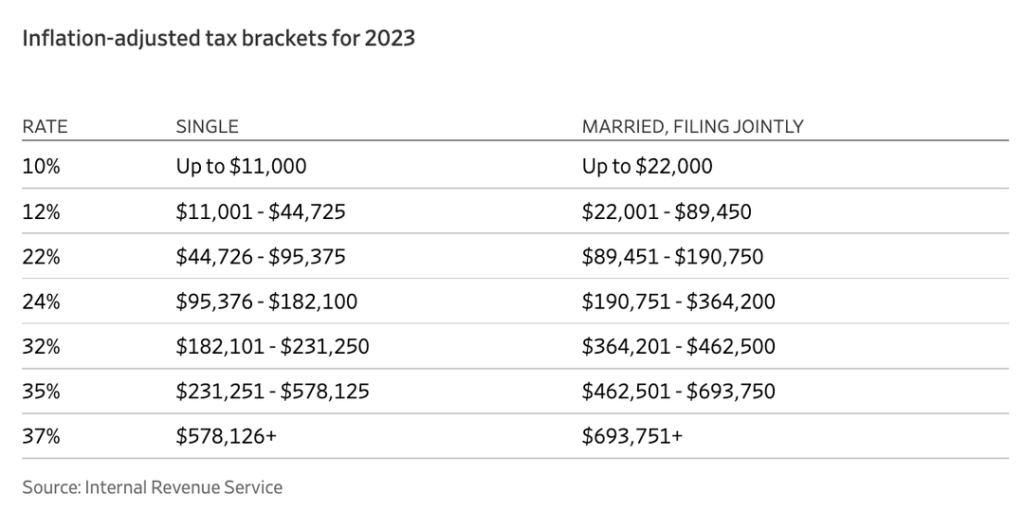

Inflation Adjusted Tax Brackets for 2023

For a hypothetical 40-year-old single taxpayer, Maria, whose earnings stay flat at $100,000 in 2022 and 2023, the inflation adjustments to the standard deduction and brackets would mean paying Uncle Sam $508 less for the 2023 tax year than for 2022, Mr. Armstrong says. If she gets a 4% raise to $104,000 for 2023, then she’ll owe $372 more. That is a 2.5% increase in tax from 2022, compared with a 4% increase in income, leaving her with greater take-home pay.

For a hypothetical 40-year-old single taxpayer, Maria, whose earnings stay flat at $100,000 in 2022 and 2023, the inflation adjustments to the standard deduction and brackets would mean paying Uncle Sam $508 less for the 2023 tax year than for 2022, Mr. Armstrong says. If she gets a 4% raise to $104,000 for 2023, then she’ll owe $372 more. That is a 2.5% increase in tax from 2022, compared with a 4% increase in income, leaving her with greater take-home pay.

Maria’s top bracket is 22%. That doesn’t mean that all of her income is taxed at 22%. Tax brackets are graduated. That means some income isn’t taxed at all, then the next slice of income is taxed at 10%, then 12%, then 22%, up to 37% for the highest earners. As the bracket thresholds move up with inflation, more of your income stays in the lower brackets, taxed at lower rates.

After the inflation adjustments, less of Maria’s money is taxed at the higher brackets. If she gets a raise, the additional income is taxed at her highest bracket.

The standard deduction, which shields some income from taxes, and the income thresholds where tax rates take effect will both rise about 7% in 2023, for tax returns to be filed in early 2024. Nearly nine in 10 taxpayers took the standard deduction in 2019, according to the IRS, instead of itemizing deductions.

The inflation adjustments also affect tax deductions for workplace benefits such as 401(k) retirement accounts, healthcare flexible-spending accounts and commuter accounts. By maxing out these accounts, taxpayers can lower their tax bills further, says Mr. Henry-Moreland.

Here’s How the Math Works

The standard deduction, a catchall amount you can subtract from your income before you pay taxes, got a big inflation boost to $13,850 for 2023, up from $12,950 this year, for single filers. Your income minus the standard deduction is your taxable income.

- For Maria, that is $100,000 minus $13,850, for taxable income of $86,150. The increase in the standard deduction alone is keeping her tax bill down.

- Next, you apply tax rates, which range from 10% to 37%, to your taxable income.

- Maria will reach the 22% tax bracket, which for single filers will kick in at $44,725 in 2023, up from $41,775 this year.

- She will pay 10% on her taxable income up to $11,000, 12% on income from $11,001 to $44,725, and 22% on the income above that. This adds up to a total bill of $14,260 for 2023, compared with $14,768 for 2022.

If Maria were married and she and her spouse earned $300,000, they would take a $27,700 standard deduction in 2023, up from $25,900 in 2022. They would reach the 24% bracket. If their income was flat, their savings would be $1,309. If they got a 4% raise to $312,000, they would owe $1,565 more than they did for the 2022 tax year. Despite the increased tax bill, their take-home pay would still be higher.

In addition to tax brackets and the standard deduction, the IRS also made inflation adjustments to many employee benefits, and by maxing those out taxpayers can save even more, said Mr. Henry-Moreland. The typical way these accounts work is that you choose to have money diverted directly from your paycheck into the accounts, and it comes out before tax, reducing your taxable income. If you don’t have the means to max out these accounts, consider at least making contributions proportionate to the amount your income increases, he says.

For example, if Maria has health insurance through work, and her employer offers a healthcare flexible-spending account, she could put $3,050 into the account for 2023, up from $2,850 this year. By using that account to pay for out-of-pocket healthcare expenses, including her insurance deductible, she won’t have to pay income taxes on any of that money. So it is like getting 22% off healthcare expenses, based on her top 22% tax rate.

- If Maria commutes to work by public transit, she can set up a commuter tax account and put up to $300 a month into it for 2023, up from $280 this year, to use for commuting expenses.

- The amount workers can contribute to 401(k)s and similar workplace retirement accounts is also adjusted for inflation and will increase to $22,500 for 2023 from $20,500 this year.

- Assuming Maria gets the raise to $104,000 and maxes out all of these accounts, her taxable income would be reduced by $29,150, down to $61,000, Mr. Armstrong says.

- In the scenario where Maria is married, the value of these tax breaks is greater, as the couple’s top rate is 24%.

- For someone who got a big raise this year and doesn’t expect one next year, it might be better to grab some of those extra deductions before year-end, says Mr. Henry-Moreland.

Write to Ashlea Ebeling at ashlea.ebeling@wsj.com

Copyright 2020 Dow Jones & Company, Inc. All Rights Reserved.

This article was reprinted with permission by WALL STREET JOURNAL. The views expressed herein are those Ashlea Ebeling and do not necessarily reflect the views of The H Group. This article was legally licensed through AdvisorStream.

The H Group does not render legal, accounting or tax advice. Please consult your tax or legal advisors before taking any action that may have tax consequences.