With the markets down from this time last year, Roth conversion may be a perfect option to yield additional tax benefit when moving money.

Using Roth Conversions to Reduce Taxes and Give Tax Free Money to Family

Using Roth Conversions to Reduce Taxes and Give Tax Free Money to Family

James Brewer, Contributor

Nov. 1, 2022

A Roth Conversion may reduce your lifetime tax bill. It reduced the lifetime taxes over $300,000 for the fictitious case illustrated later. It could save you on taxes you will pay on your traditional pre-tax 401(k)/403(b) savings, as well as your IRAs. What is a Roth conversion? You tell the IRS that you want to pay the taxes on your pre-tax retirement savings before they mandate that you do. Today, you may be in a different or ideally, lower tax bracket than you were when you saved the money. It would be better to pay the taxes now at a lower tax bracket.

Many people are unaware that a tax bill will be due on their IRA/401(K)/403(B) monies because of required minimum distributions. What if you decided not to wait, and paid taxes based on your own decisions? Let’s look at a fictitious case of Renee and Chuck that I developed using MoneyGuide Elite tweaked by their representative, Adam. Renee makes $120,000 and Chuck is a stay-at-home husband. Renee is 60 and Chuck is 62. Renee plans to work until 65 and it’s projected that she will live to 100. The Roth Conversion starts in 2027 and ends in 2036, not exceeding a 24% Max Bracket. Here’s what assets Renee and Chuck have to work with.

Many people are unaware that a tax bill will be due on their IRA/401(K)/403(B) monies because of required minimum distributions. What if you decided not to wait, and paid taxes based on your own decisions? Let’s look at a fictitious case of Renee and Chuck that I developed using MoneyGuide Elite tweaked by their representative, Adam. Renee makes $120,000 and Chuck is a stay-at-home husband. Renee is 60 and Chuck is 62. Renee plans to work until 65 and it’s projected that she will live to 100. The Roth Conversion starts in 2027 and ends in 2036, not exceeding a 24% Max Bracket. Here’s what assets Renee and Chuck have to work with.

- 401(k) $800,000 with annual additions of $7,200

- Rollover IRA $200,000

- Contributory IRA $75,000

- Roth IRA $50,000

- Non-retirement $100,000 with annual additions of $10,000

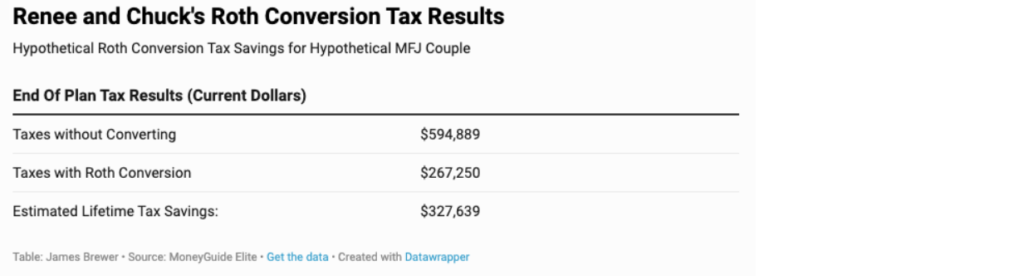

The table below shows that taxes have decreased $327,639. This required them to pay more in taxes than they otherwise would have during the conversion. It is difficult to know when one of the spouses might pass on. Given that single taxpayers have lower income tax bands and spending by the surviving spouse is 75%, there could easily be more tax erosion.

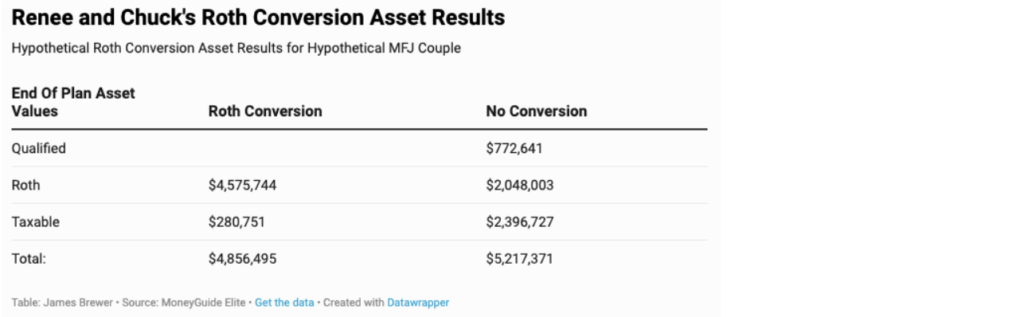

The Roth assets passed to heirs has more than doubled, significantly decreasing the taxes on the assets being passed to them. This far outpaces the fact that a small amount of assets are being passed to heirs. Current laws would require the qualified money [IRA/401(K)/403(B)] to be taxed over no more than 10 years. Inherited IRA money is added to the heirs existing income.

The Roth assets passed to heirs has more than doubled, significantly decreasing the taxes on the assets being passed to them. This far outpaces the fact that a small amount of assets are being passed to heirs. Current laws would require the qualified money [IRA/401(K)/403(B)] to be taxed over no more than 10 years. Inherited IRA money is added to the heirs existing income.

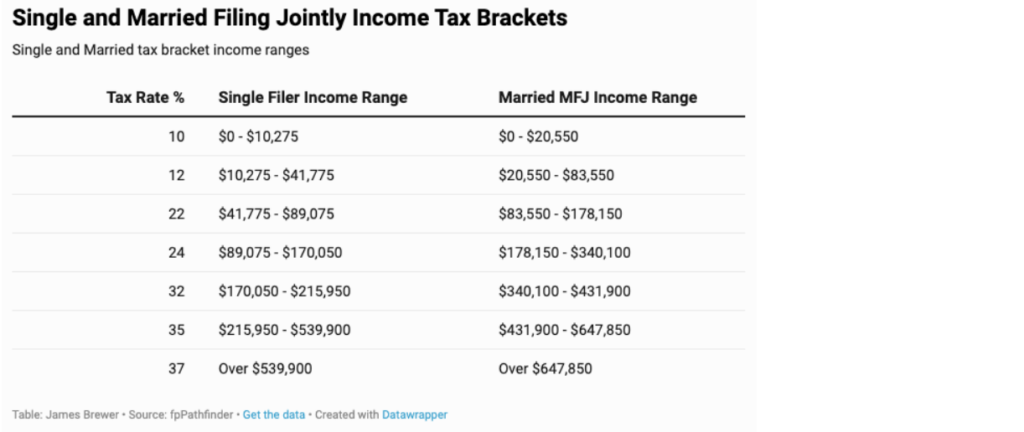

Let’s examine some of the mechanics of a Roth conversion. I’ll illustrate assuming a worker under 50 making $120,000. Their income over $89,075 is taxed at 24%. We’ll use the marginal tax bracket for a Single filer table to help illustrate how taxes would apply on the conversion:

Let’s examine some of the mechanics of a Roth conversion. I’ll illustrate assuming a worker under 50 making $120,000. Their income over $89,075 is taxed at 24%. We’ll use the marginal tax bracket for a Single filer table to help illustrate how taxes would apply on the conversion:

How you answer some key questions may sway your thinking on conversions:

Do you have a Roth IRA?

Do you have a Roth IRA?- Do you have a Roth 401(k)/Roth 403(b)?

- Do you have outside assets?

- Are you a small business owner?

Do you have a Roth IRA?

I’ll use a yes answer. Assume you have some prior 401(k)s and IRA accounts totaling $25,000. You can simply tell the custodian of your Roth IRA and the IRS that you are converting those monies to your Roth IRA. You add the $25,000 to your $120,000 for a new income of $145,000. The additional $25,000 is taxed at 24% for an additional tax of $6000. As you aren’t withdrawing the money, you don’t trigger the 10% early withdrawal penalty. You can simply pay the additional amount of pocket, using your income or withdrawing from an account with $6000 in it. Some people may want to pay the taxes out of the $25,000 itself. A withdrawal of $6000 would itself require a larger withdrawal of because the withdrawal would be taxed. If you’re under 59 ½, it would also add an early withdrawal penalty.

Now let’s assume that you have $500,000 in IRA, 401(k) and 403(b) monies. If you convert the whole amount, you will pay in three different tax brackets. On the first $50,050 you would pay 24% tax, the next $45,900, 32% tax, the next $323,950, 35%, and the next $80,100, 37% tax. That would make the total tax bill $169,720. That would be more than your income, so you would need an outside account to pay for it. Rather than converting the whole amount, you could do partial conversions. If you converted $50,000, keeping you in the 24% tax bracket, you could pay $12,000 per year for 10 years ($12,000 * 10 years = $120,000). That would save you $37,720 ($169,720 – $120,000 = $37,720). While that looks great on the surface, that assumes that tax rates don’t go up in the future.

Are you a participant in a Roth 401(k)/Roth 403(b)?

If yes, you can do in-plan Roth 401(k) conversion. You should reach out to the recordkeeper (at your current employer) of your plan to learn their conversion process. In this case, you can only convert your traditional savings in this 401(k). Do you have 401(k) or 403(b) savings at previous employers? If so, you could rollover those monies into your current 401(k) which would increase the amount you could convert.

The in-plan Roth 401(k) conversion does have a downfall. All 401(k) monies are subject to required minimum distributions. These monies will increase your required minimum withdrawals compared to if they were in a Roth IRA and would not be aggregated with your other contributions. Those don’t kick in until age 72, so you may have some time to figure out a different plan to avoid the downfall.

A Roth conversion can be implemented whenever the timing is right. I recommend working with a Certified Financial Planner that will work in concert with your Certified Public Accountant or Enrolled Agent (IRS approved tax agent). May the tax savings be with you!

By James Brewer, Contributor

© 2022 Forbes Media LLC. All Rights Reserved

This article was reprinted with permission by Forbes Media LLC. The views expressed herein are those of James Brewer, contributor, and do not necessarily reflect the views of The H Group. This Forbes article was legally licensed through AdvisorStream.

Contact one of our financial advisors today to discuss your situation.