What would be the impact of a Trump Presidential reelection for a second term? How important is the President on financial markets anyway?

In many ways, policies to expect would likely be similar to what’s in place today, and largely opposite of those proposed under a Biden administration discussed a few weeks ago. At the same time, Trump’s policies have not followed ‘traditional’ Republican ideologies from decades past in a variety of areas. The Senate Republicans have been far more predictable from a policy standpoint, as have the Congressional Democrats.

The practical factor for the election continues to be whether or not the Democrats are able to take the Senate from the Republicans, which, in addition to holding the House, would allow for the ability to push through a greater volume of progressive legislation. A split-party legislative and/or administrative branch could result in four years of gridlock, with little net change in policy. (That might be perceived as the ‘worst case’ or ‘best case’ depending on the observer.)

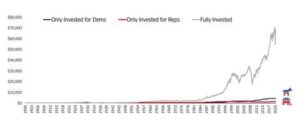

Little may change from a higher-level view if the first Trump term morphs into a second. But, it’s important to remember from a financial markets perspective that the President in power has been relatively unimportant in driving longer-term sentiment and returns. Attempting to time election results or moving out of markets to avoid volatility can result in sub-optimal results, even though the weeks prior to an election can become more volatile. Interestingly, in the cases where an incumbent is seeking re-election, one of the few consistent tendencies over the past century is based on U.S. stock market results in the three months prior to Election Day. Based on the S&P 500, a positive return for that stretch has proven favorable for an incumbent’s chances, while a negative return has favored the challenger. (For perspective’s sake, from the window starting Aug. 3, the market is up 0.75% through Fri., Sept. 18—with several more weeks to go until Nov. 3.)

That said, while politics can coincide with day-to-day financial market movements at times, the two rarely correlate meaningfully over the long haul. The charts below bear this out fairly dramatically.

Source: Invesco, top chart as of 6/30/20, bottom chart as of 8/31/20.

The following policy items assume that a Trump reelection is accompanied by Republicans retaining the Senate, which creates a ‘status quo’ situation. A newly Democratic senate majority would create more of a wildcard:

- It is probably safe to assume the tax cuts from 2017 would remain in place. These have served to benefit corporations, which receive an immediate boost to the bottom line, resulting in higher reported earnings. Consequently, this models out to higher multi-year growth and justifies higher equity valuations. Personal income tax rates would likely also remain low, along with capital gains rates. Traditional supply-side economists argue that stronger corporate performance and fewer hurdles (such as regulation and taxes) result in a larger ‘pot’ for everyone. However, this assumes that wealth trickles down proportionately to all workers, which has been debated in recent years as income equality between different groups has widened.

- This would also be assumed to be status quo, which includes minimal promotion of green technologies. It would likely be coupled with a pushback on more stringent standards, such as those adopted by California (whose standards predate the EPA and are often stricter). While the energy sector has been struggling with low petroleum prices, due to weaker demand due to the pandemic, current policies would keep additional regulatory headwinds at bay. However, energy firms have been hurt far more by weaker demand from the pandemic than by other factors.

- S.-China relations and trade. The geopolitical tension with China has been steadily growing, and a status quo result would assume more of the same. It’s been claimed by some China experts that the country is currently just playing a ‘waiting game’—for the Trump administration to eventually end, and to instead deal with the successor. As part of their 50- and 100-year national plans, such a delay is seen as just a temporary roadblock. The important component is that a tough U.S. stance on China has support across the aisle—it’s one of the few policy items both parties agree on. So, a longer-term decoupling is likely, although the public stances and negotiation styles could differ between administrations.

- Antitrust legislation. In years past, some Democratic platforms have been seen as anti-corporate (and conversely, pro-worker). This would have translated to a crackdown on large ‘oligopolies’ and a reining in of corporate power in the economy and society. In the current case, argued by some due to the more progressive political leanings of large tech companies, Democrats have appeared less interested in breaking up these firms. Republicans have certainly appeared more interested. Since it’s not quite clear where any ‘abuses’ lie and how consumers are adversely affected (many argue they’ve benefitted greatly through both product variety and cost), this issue remains complex and path unclear.

- In line with trends seen globally, not just in the U.S., both parties have taken on a more populist tone in recent years, largely in keeping with the larger societal income gaps. The polarization has taken place far more on the political side than the socioeconomic side, as all parties want to be seen as ‘pro-working class.’ This creates a conundrum, although no clear evolution in policy. Continued trade restrictions may help U.S. firms in the near term, although it’s not clear that benefits trickle down to workers longer-term and could hurt consumers through higher prices. Contrary to the Biden agenda, a second Trump administration would make more progressive items, such as a higher minimum wage and other benefits less likely—although these also depend on the Congressional makeup.

- As we noted under the Biden platform comments a few weeks ago, a Trump administration would likely continue to fight ‘Obamacare,’ and continue support for the current private insurance-based healthcare model. Despite the battles over universal coverage/single-payer format, there remains no constructed alternative to the current system for legislators to gravitate to. However, there is bi-partisan populist support for better regulation of high pharmaceutical prices and plugging some gaps to help reduce medical care costs for seniors. The industry has fought back on pharma prices, arguing that profits feed back into research and development for important new therapies, so this has largely resulted in a stalemate in recent years.

- A traditional Republican policy platform has been a strong defense base. This is thought likely to persist, although the Trump administration has focused on far less global interventionism. This hasn’t manifested completely, but could continue to play a role in broader policy thinking. At the same time, China has been viewed as an increasing global military threat, which would necessitate further spending. The trend has been moving from conventional military spending towards new technologies, such as cyberwarfare, satellites, drones, etc.—all of which are technologically complex and expensive.

- The border ‘wall’ has largely been symbolic, as the Trump administration has clamped down on immigration mostly through policy, which would seem likely to continue in a second term. This has provided a seeming veil of protection for U.S. workers (championed by both candidates in different ways), but economists, who view labor in a global context, see increased restrictions of any kind as a hurdle to stronger economic performance. This is a complex issue, with outcomes the result of multi-decade trends, so the policy action of a single President may only provide a short-term impact on GDP growth. Demographics and business/worker competitiveness play a far more important role, with job training and education enhancements acting as a behind-the-scenes policy championed by many but not discussed as much by candidates in terms of specific plans.

- Less stringent regulatory environment. The President promised to rollback regulations imposed over the past administration, including the expanded use of executive orders, and that has certainly occurred. It’s likely another four years would continue regulation downsizing, in a generally pro-business way, including financial markets and their oversight.

- Fiscal policy. The old stereotypes have been cast aside, as parties on both sides are in a spending mode. Republicans are a bit less in favor of direct stimulus to workers (at least in the same large amounts Democrats have been), and more in favor of corporate injections. During the pandemic, airlines and the travel industry have been lobbying especially hard for more aid. This pandemic will end up being expensive regardless of who ends up in the White House, with debt ramifications far beyond the next four years.

- Monetary policy. As noted earlier, a central bank should be agnostic to political pressures, but that has been easier said than done. Pressure to lower rates or keep policy as ‘easy’ as possible is preferred, since it coincides with keeping the economy growing—which most administrations prefer under their watch. The U.S. Fed has sidestepped such pressure far better than in some countries, of course, but a continuation of the current administration and ‘tweeting’ about central bank decisions runs the risk of negatively influencing public opinion about the Fed and its functions. Politics can also appear in the nomination of certain new board members, such as the controversial Judy Shelton (who has favored revisiting the gold standard—a position rejected by many mainstream economists). Regardless, the Fed has continued to stay out of the political fray over the decades, despite a variety of administrations holding opposing views.

- Judicial branch. The Supreme Court is typically not a top concern of financial markets, but with the passing of Justice Ruth Bader Ginsburg, a position on the bench has opened. Any new appointee’s political leanings can tilt the balance of key decisions toward either the conservative or progressive end of the spectrum. So, this can have ramifications for decisions involving business, regulations, or any other economically-relevant area.