As stock markets flailed and the age of zero interest was only slowly beginning to end, 2022 was not kind to investors. In Wall Street’s worst year since the Great Recession , most shareholders left the markets owning less than what they started with. Those with more conservative investments, like a savings account, could have had the last laugh—at least their funds were not diminishing—had it not been for 2022’s rampant inflation that made even a stagnant account balance worth quite a bit less in real world terms.

For more adventurous investors with the right amount of money, so-called luxury investments or investments of passion could have been a way out. The recently published Knight Frank Wealth Report shows flashy asset options outside of stocks and other financial products that blew past last year’s inflation rate with their average increases in value.

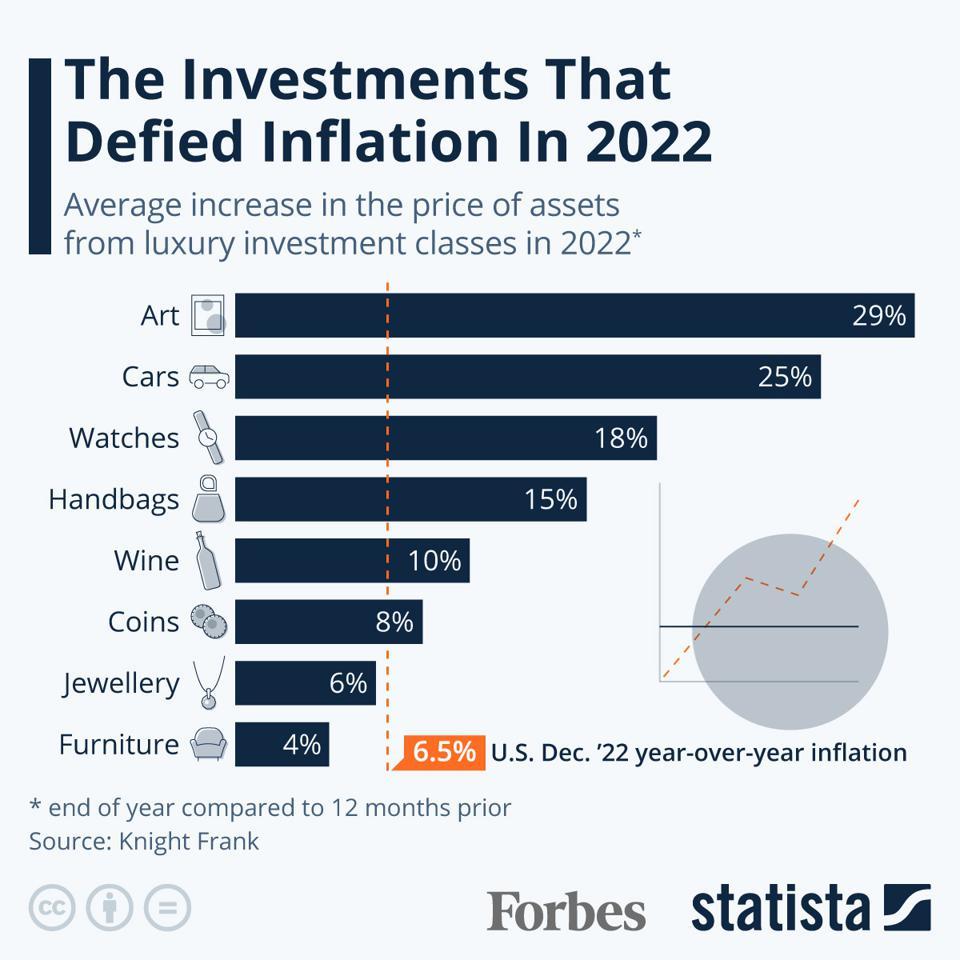

This chart shows the average increase in the price of assets from luxury investment classes in 2022.

Statista

Leading the list last year were investments in art, as the asset class increased in value by an average of 29%. Somewhat more accessible might be an investment in a classic car, up in value 25% across the category, or in a statement watch, which would have increased its worth on average by 18%. Handbags, expensive wine and collector coins were still up more than inflation between the beginning and the end of 2022, making them an investment option for those with a smaller pocketbook—given that enough knowledge about the right item to buy exists.

Some luxury asset classes did in fact not make the inflation cut in 2022. This includes the average price increase for jewellery and furniture as well as colored diamonds and rare whisky bottles—despite the fact that the latter category is identified by Knight Frank as having had the biggest jump in value over the past ten years at an enormous 373% increase.

Still the best of the worst

At a 3-6% value increase, these below-inflation luxury asset classes still beat the average savings account interest rate, which stood at only 0.35% in early 2023 despite central banks rates having left zero interest territory. The more complicated and higher-risk nature of luxury investments, however, naturally deters many investors.

The Knight Frank report also breaks down among wealthy clients from which continents certain luxury investments are most popular. A survey of 500 private bankers, wealth advisors, intermediaries and family offices reveals that in Europe and the Americas, lucrative art is by far the most common luxury or passion investment class. In Asia, art ties with watches and places just before wine, while in Africa, classic cars are the most sought after, followed by jewellery.

Charted by Statista

By Katharina Buchholz, Contributor

© 2023 Forbes Media LLC. All Rights Reserved

This article was reprinted with permission by Forbes. The views expressed herein are those KATHARINA BUCHHOLZ and do not necessarily reflect the views of The H Group. This Forbes article was legally licensed through AdvisorStream.