A debt ceiling fight is looming in the U.S. yet again, giving investors another worry for markets this year.

A debt ceiling fight is looming in the U.S. yet again, giving investors another worry for markets this year.

The U.S. government’s deadline to raise the $31.4 trillion debt ceiling could be sooner than expected, analysts have said, pulling forward the risk of a debt default that could have wide repercussions across global financial markets.

Recurring legislative standoffs over the debt limits this last decade have largely been resolved before they could ripple out into markets. That has not always been the case, however: A protracted standoff in 2011 prompted Standard & Poor’s to downgrade the U.S. credit rating for the first time, sending financial markets reeling.

Recurring legislative standoffs over the debt limits this last decade have largely been resolved before they could ripple out into markets. That has not always been the case, however: A protracted standoff in 2011 prompted Standard & Poor’s to downgrade the U.S. credit rating for the first time, sending financial markets reeling.

Some investors worry the Republican party’s narrow majority in Congress could make it harder to reach a compromise this time.

Here is a Q&A about the implications for markets:

WHAT IS THE DEBT CEILING?

The debt ceiling is the maximum amount the U.S. government can borrow to meet its financial obligations.

HOW LONG BEFORE THE ‘X-DATE’?

U.S. Treasury Secretary Janet Yellen said in January the government could pay its bills only through early June without increasing the limit, which the government hit in January.

Some analysts had forecast the government would exhaust its cash and borrowing capacity – the so-called “X Date” – sometime in the third or fourth quarter, but weaker-than-expected tax receipts for the April filing season could pull that deadline forward.

Goldman Sachs analysts estimated that if April tax receipts are down by 35% or more year on year, the Treasury could announce an early June debt limit deadline. But if receipts finish down by less than 30%, a late July deadline is more likely.

“Whereas there was once a time when the Treasury Department was seen as having sufficient funding to reach August or even September … the area of focus has now been pulled forward to June, or even as early as late May,” BMO Capital Markets analysts said.

WHAT CAN THE TREASURY DO TO MEET ITS OBLIGATIONS?

It can use cash on hand and extraordinary measures to generate cash once the debt limit is reached.

The U.S. Treasury brought in $129.82 billion in total tax receipts on April 18, the annual tax filing deadline. The collections brought total deposits into the Treasury General Account at the Federal Reserve to $283.53 billion on that day, with a closing balance of $252.55 billion after withdrawals.

DO BOND PRICES REFLECT U.S. DEFAULT RISKS?

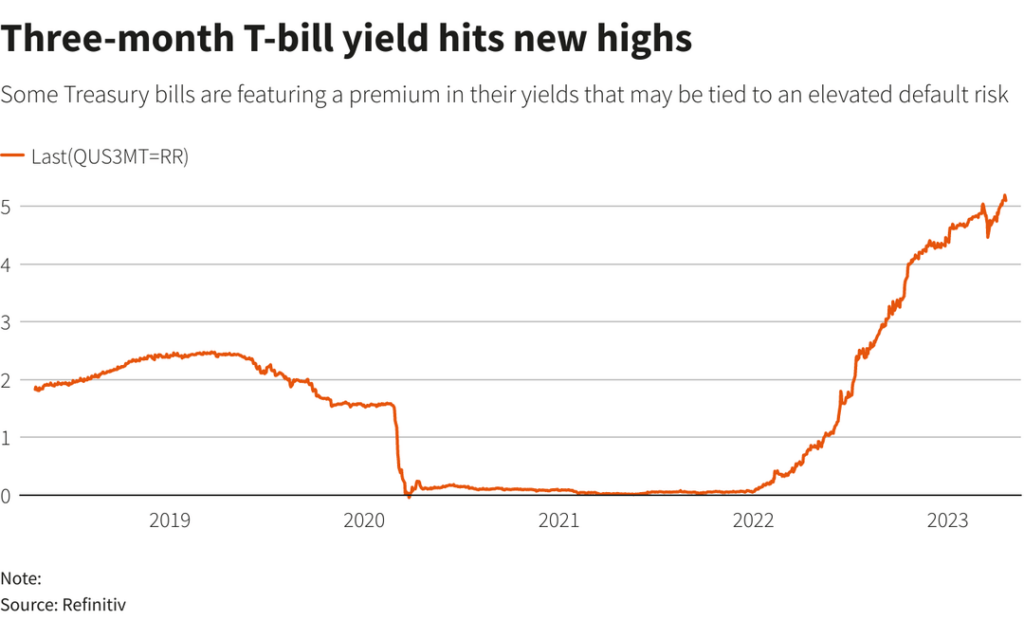

Some Treasury bills (T-bills) are featuring a premium in their yields that may be tied to an elevated default risk, according to some analysts.

Three-month T-bill yields hit a new 22-year peak of 5.318% on Thursday.

“The T-bills are telling us that money market funds and others are avoiding bills that could be impacted by a government shutdown,” said Steve Sosnick, chief strategist at Interactive Brokers.

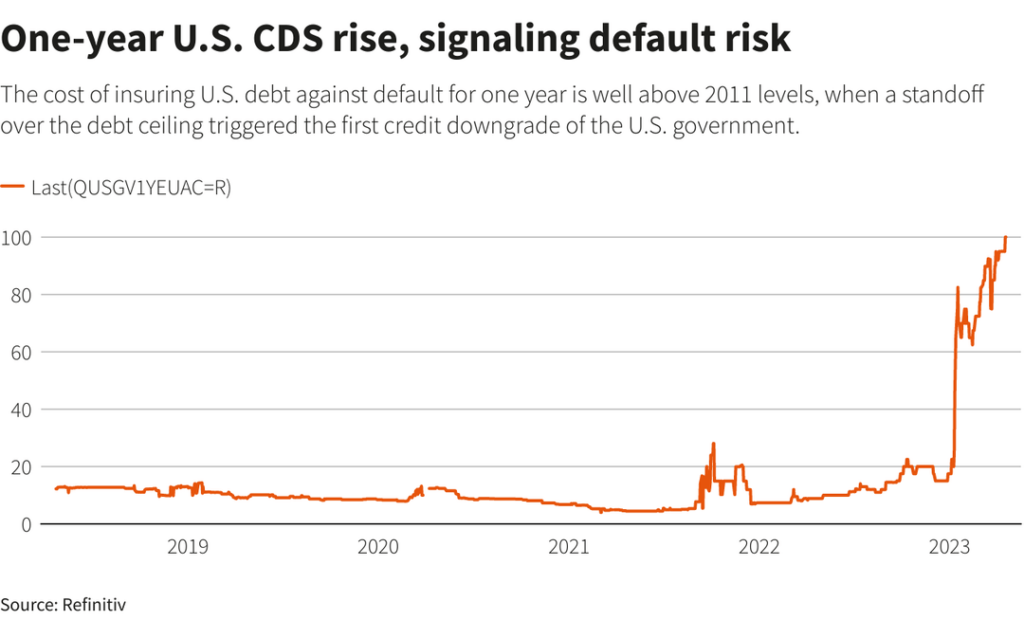

Spreads on U.S. five-year credit default swaps – market-based gauges of the risk of a default – widened to 50 basis points, data from S&P Global Market Intelligence showed , more than double the level in January.

The cost of insuring U.S. debt against default for one year stood at over 100 basis points – well above 2011 levels, when a standoff over the debt ceiling triggered the first credit downgrade of the U.S. government.

WHAT HAPPENS IF THE U.S. DEFAULTS?

The rising risk of a default could push some investors to move money into international equities and foreign governments’ bonds.

At the same time, paradoxically, a potential default could also lead to a flight to quality, pushing Treasury yields lower.

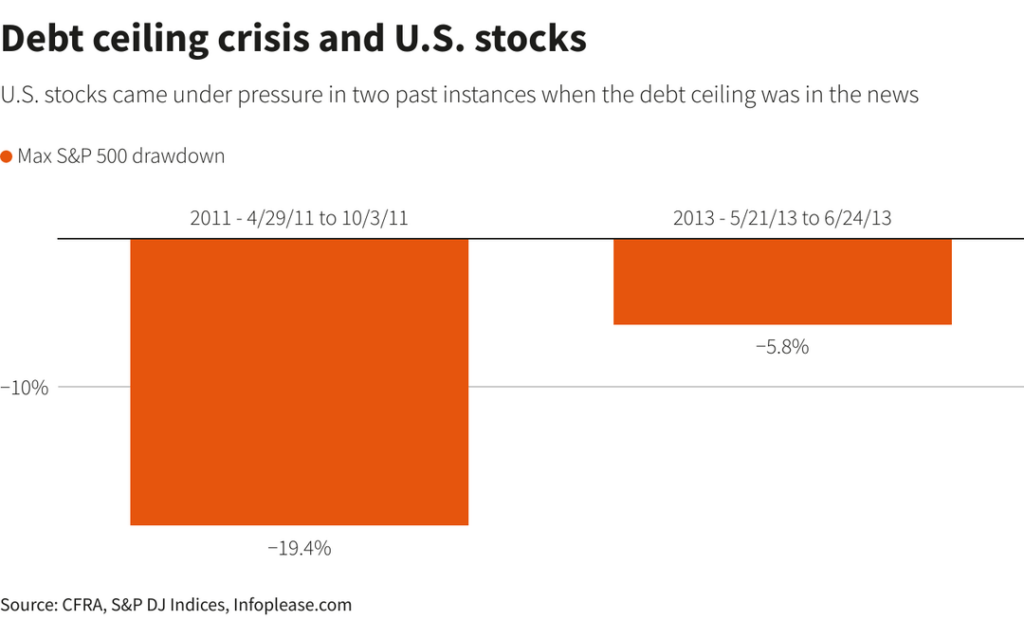

In 2011, political gridlock in Washington over the debt ceiling sparked a stocks sell-off and took the U.S. to the brink of default, with the country losing its top-tier AAA credit rating from Standard & Poor’s.

Goldman Sachs in a research note said the S&P 500 fell 15% during the 2011 crisis with stocks with the greatest sales exposure to U.S. federal spending plunging by 25%.

In 2021, some equity weakness and anomalies in the pricing of short-term Treasury bills showed rising concerns as Congress faced approaching deadlines to fund the government and address the debt ceiling.

An actual U.S. debt default would likely send shockwaves through global financial markets, as investors would lose confidence in the U.S. ability to pay its bonds, which are seen as among the safest investments and serve as building blocks for the world’s financial system.

That “could leave some lasting scars, including a permanent increase in the cost of funding U.S. federal debt,” said David Kelly, chief global strategist at J.P. Morgan Asset Management.

NEW YORK, April 20 (Reuters) –

By Davide Barbuscia

April 27, 2023

Reporting by Davide Barbuscia, Additional reporting by Saqib Iqbal Ahmed; Editing by Megan Davies and Josie Kao

This article was reprinted with permission by REUTERS. The views expressed herein are those Davide Barbuscia and do not necessarily reflect the views of The H Group. This article was legally licensed through AdvisorStream.