We treat wealth management and planning as collaborative processes with you. Then we take it one step further by collaborating with our colleagues, some of the best in the business. We also rely upon a very talented and credentialed staff to execute our investment strategies and provide day-to-day portfolio management, research, and compliance.

Our Services

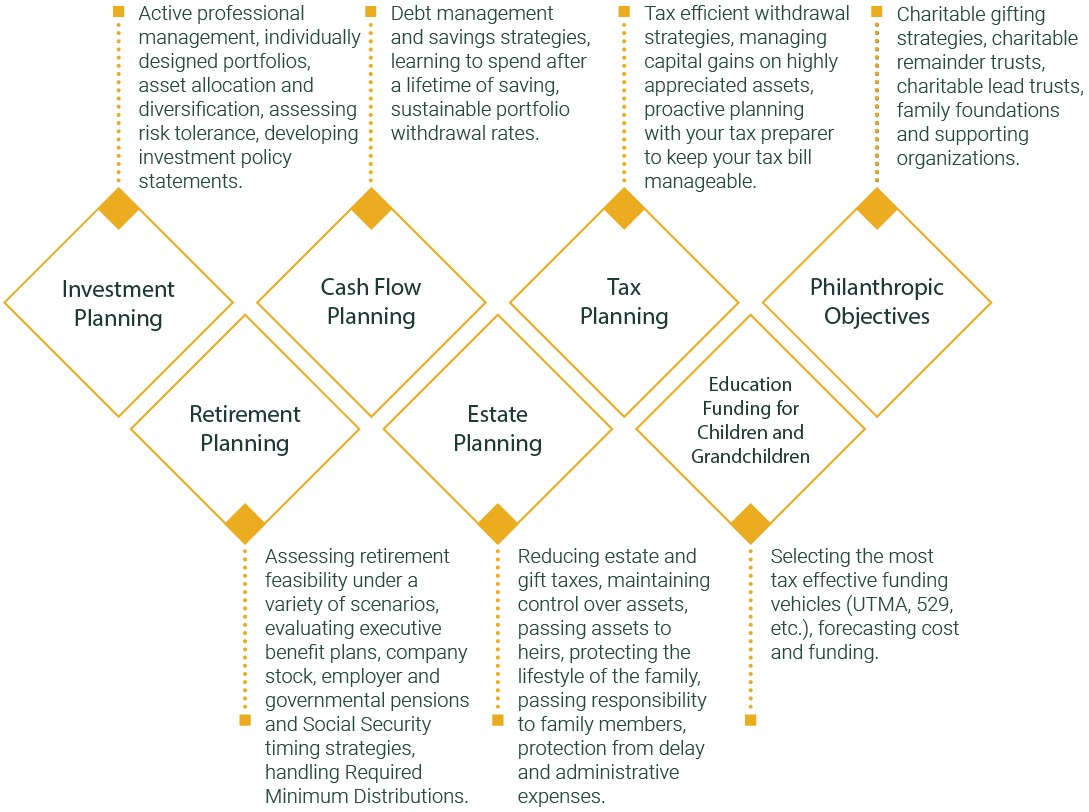

As a lifelong, comprehensive financial planning partner to our clients, we are proud to offer you guidance and collaboration in our many areas of services.

HOW WE DO IT

Establishing a relationship with a CERTIFIED FINANCIAL PLANNER™ professional is one of the smartest things you can do to secure your financial well-being. It’s not uncommon to spend 20 or 30 years of your working career with your nose to the grindstone, socking away some money because you know you should, but lacking efficiency and a framework for how all your financial pieces fit together.

Investment Management

We design individually managed portfolios tailored to meet our clients’ needs. After extensive research and rigorous analysis, we will develop an investment plan to meet your long-term objectives, resources and risk tolerance.

Our investment philosophy has evolved over many years of experience. This conservative philosophy is based on minimizing risk while targeting a rate of return sufficient to meet your goals. Time, patience and a strict discipline are the cornerstones of our success.

We manage investment portfolios on a fee basis. Our clients pay no commissions. This eliminates conflict of interest and allows us to adjust portfolios as needed without incurring unnecessary costs.

Our management fee also serves as a retainer for ongoing financial advice. We encourage our clients to consult with us on all their financial decisions.

Retirement and Lifestyle Planning

Prudent retirement planning can help protect decades of hard work and the careful accumulation of wealth from the inevitable impact of taxes and inflation.

Key components of a successful retirement plan are:

- Portfolio survival analysis, utilizing state-of–the-art techniques to determine the feasibility of reaching your goals

- Tax-advantaged investment strategies to maximize your nest egg during the accumulation phase of your life

- Minimum distribution requirements from retirement plans and strategies to avoid tax penalties on early retirement plan distributions

- Evaluating highly appreciated stock and stock option plans for minimum tax impact during retirement years

- Determining optimum retirement plan distribution options including lifetime income and lump sum payments

Reaching retirement is an event to be celebrated and treasured for its unlimited possibilities. With that in mind, we provide sound and thoughtful planning alternatives to help you ensure a long, happy and financially secure retirement.

When you become a client, your goals become our goals. We are dedicated to helping you build and protect your wealth – and realize the life you envision.

FIRST MEETING

Generally, we like to visit briefly and confidentially over the phone first. If we agree that we can add value to your situation, we’ll set a time to meet with you via Zoom or in person. The purpose of the first face-to-face meeting is for us to learn in more detail how we can improve upon your existing plan and portfolio management. In addition, it is an opportunity for you to learn more about us and for us to determine if we are a good mutual fit.

WHAT TO BRING

A handshake and what’s on your mind are a great start. Bring any statements or paperwork you feel will be helpful for this initial meeting. We have provided a list to help you pull together your thoughts and concerns. However, these documents are not required for the initial meeting.

OPTIONAL DOCUMENT CHECKLIST

Bring any paperwork you feel will be helpful for this initial meeting. Here are some suggestions:

- Most recent statements of all assets (i.e. bank, brokerage, IRA, annuity and work retirement plan statements)

- Social Security estimate of benefits, if available

- Most recent State and Federal Income Tax returns

- Most recent pay stubs

- Any other income sources (i.e. rental income)

- Your current Wills and/or trusts

- Insurance policy statements (Home/Auto/Liability)

- Life insurance policy death benefit amount, premiums paid, cash value. Please include policies owned by you or a trust, or any of which you are the beneficiary.

- Disability policy benefits statement

- Estimated value of your home – property tax statement

- Value of any other real property you own

- For any debt, (i.e. mortgages, auto loans, student loans) statements that include: remaining balance, interest rate, terms, payment amount